IPAF Publishes 2025 Rental Market Reports, Revealing Slower Growth Amid Economic Uncertainty

The International Powered Access Federation (IPAF) has published its 2025 Rental Market Reports, featuring expert insight into the MEWP rental markets across Europe, the US, and Asia.

In 2024, the MEWP rental markets in both Europe and the US continued to grow in revenue, fuelled by sustained demand, increased rental rates, and inflationary factors. However, the pace of growth has begun to slow amid rising uncertainty, according to the latest analysis conducted for IPAF by Ducker Carlisle.

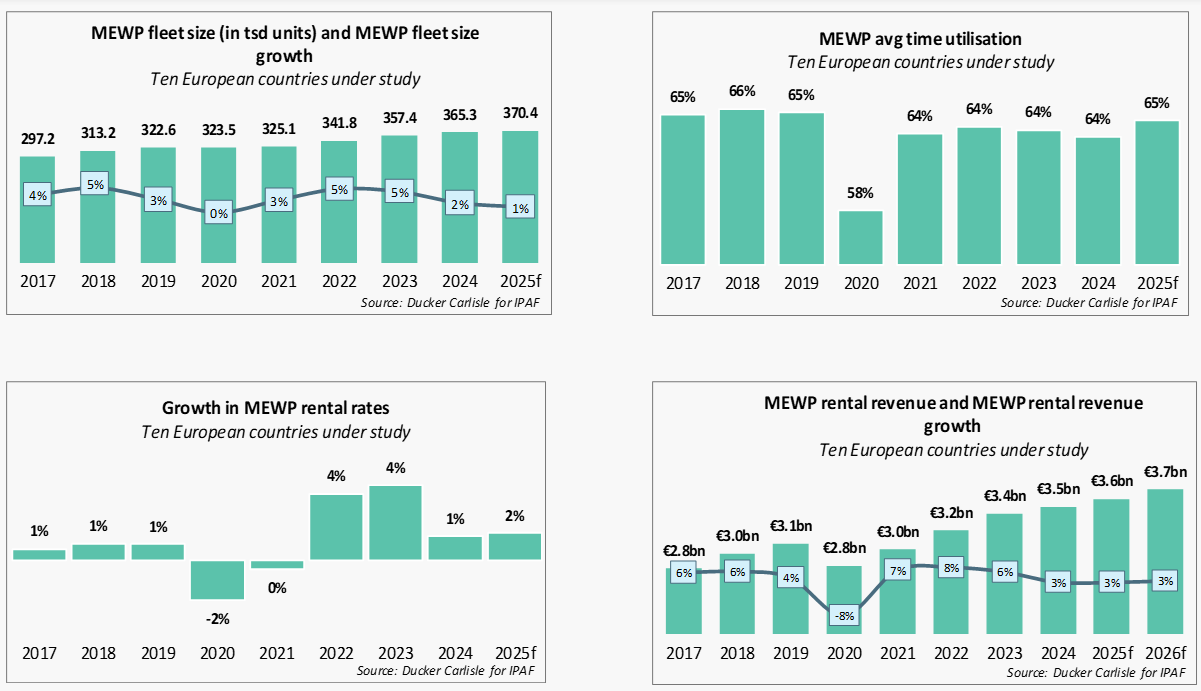

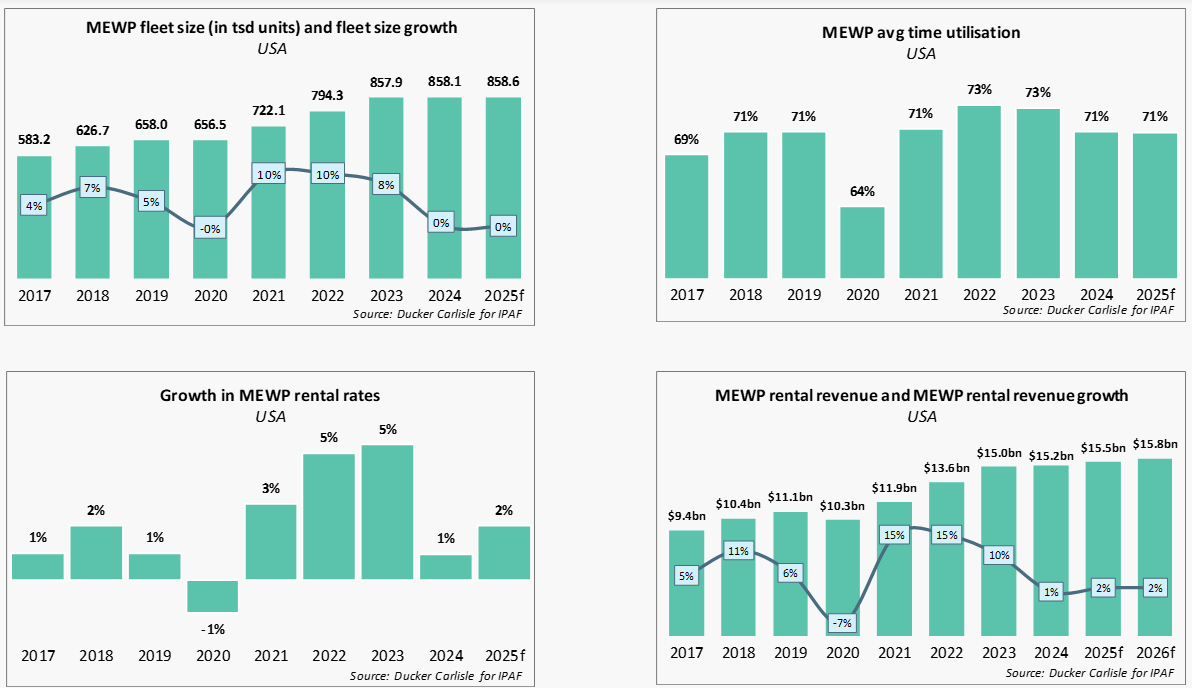

While Europe’s MEWP rental market continued to grow in 2024, the pace of expansion slowed notably compared to 2023. Modest rental rate increases, stabilised utilisation, and a more cautious approach to fleet expansion characterised the year across most countries. In contrast, the US market marked the end of its recent high-growth cycle. High interest rates and reduced construction investment contributed to cost pressures, limiting rental rate increases to just 1%. Utilization declined, and fleet growth plateaued, indicating signs of market saturation.

As the MEWP rental sector sits at the intersection of public and private investment cycles, it is increasingly affected by global geopolitical tensions, ongoing inflation, and variable construction spending. These pressures are beginning to weigh on overall market performance and future growth potential.

Europe highlights

The European MEWP rental market saw a 3% revenue increase in 2024, reaching €3.5 billion. While this reflects continued growth, it fell short of earlier expectations due to rising interest rates, inflation, and delays in public infrastructure projects. Dynamic growth was strongest in Denmark, Italy, Norway, and Spain.

Fleet expansion slowed to just 2% – adding approximately 8,000 units – as rental companies took a more cautious approach amid shorter equipment lead times, market saturation, and uncertainty in construction. France’s fleet remained flat, the UK contracted by 2%, and Italy and the Netherlands also saw slower growth.

Rental rates rose modestly by 1%, led by Nordic countries (2–3%), but pricing remained under pressure in core markets like Germany and France. Average utilisation held steady at 64%, though regional differences persisted. Growth was seen in Italy and the Nordics, while more mature markets reported declines.

Following a strong investment rebound in 2023, fleet investment fell 6% in 2024 as companies focused on renewal over expansion. While Chinese OEMs offered competitively priced machines, newly introduced tariffs in the second half of the year began to limit their market penetration.

US highlights

The North American MEWP rental market experienced a notable shift in 2024, as its high-growth cycle ended. Revenue increased by just 1% year-on-year, signalling a plateau following three years of rapid expansion. A subdued final quarter, coupled with high interest rates, rising material costs, and broader economic uncertainty, weighed heavily on the market.

Fleet growth halted, with the total MEWP fleet holding steady at around 857,000 units – marking the first year without net expansion. Utilization declined to 71%, returning to more typical levels after the overheated conditions of 2023.

Rental rates rose by only 1%, and companies prioritised utilization and cash flow over price increases. Investment also dropped significantly, falling from 13% growth in 2023 to just 5% in 2024, with firms shifting toward fleet renewal and more cautious planning.

As the market enters a correction phase, only modest rental rate growth and limited fleet expansion are forecast over the next two years.

China, India and the Kingdom of Saudi Arabia highlights

In 2024, the Chinese MEWP rental market experienced a significant downturn, with revenues declining by 19.6% year-on-year. Following several years of rapid expansion, the market has entered a correction phase driven by oversupply, reduced demand, and intense competitive pressure.

Fleet growth slowed considerably, and both utilization rates and rental prices fell sharply. Despite continued investment from some of the country’s largest players, the overall market environment turned challenging as rental companies grappled with falling margins and weakened project pipelines. This shift marks a new chapter for the Chinese MEWP rental sector – transitioning from breakneck growth to a more mature, competitive, and cost-sensitive phase.

In India, however, the MEWP market grew by 32%, driven by a 24% increase in fleet size and a 4% rise in utilization. This growth is largely due to the expanding use of MEWPs in construction projects, driven by their operational efficiencies.

In 2024, Saudi Arabia’s MEWP rental market also grew, by 33%, driven by a 18% increase in fleet size and a 2-point rise in utilization. Saudi Arabia’s Vision 2030, a long-term government initiative to transform the country, is fuelling a construction boom through megaprojects such as NEOM, Qiddiya, the Red Sea Project, and the Riyadh Metro. This surge in activity is reshaping market dynamics, attracting new rental players and incentivising existing players to expand their fleets to meet rising demand.

Peter Douglas, CEO and Managing Director of IPAF, said: “The indicators, trends, and forecasts featured in these reports offer essential insights for anyone operating in the powered access market – not only rental companies, but also equipment manufacturers, suppliers, and investors. They provide the data needed to make informed decisions on investment planning, strategic growth, and overall business direction. Don't miss this opportunity to access the latest market intelligence in the powered access industry.”

For detailed analysis of the European, US and Asian markets, the 2025 IPAF Rental Market Reports are available now.

IPAF manufacturer, supplier, distributor and rental company members can apply for a free copy of the relevant report by filling in the form at www.ipaf.org/reports; non-members are able to purchase the report.