MEWP rental markets’ pre-pandemic health will shape recovery

The healthy state of MEWP rental and positive economic trends to year-end 2019 in countries including Italy, the Netherlands, Germany and China should shape strong recoveries after the coronavirus pandemic, according to the latest analysis, conducted exclusively for the International Powered Access Federation (IPAF) by DuckerFrontier.

The newly published Global Powered Access Rental Market Report 2020 shows that those countries least hard-hit in the first wave of the pandemic are likely to recover well in 2021; the report also indicates Sweden and the US will be among markets to recover strongly after construction sites largely stayed open during the peak of the pandemic.

France, the UK, Spain and Finland were among those worst hit by the pandemic, owing to the impact of the disease and sustained national lockdowns, coupled with other underlying factors contributing to economic uncertainty, including Brexit and national elections. Outlooks are not favourable for a rapid recovery in any of these countries.

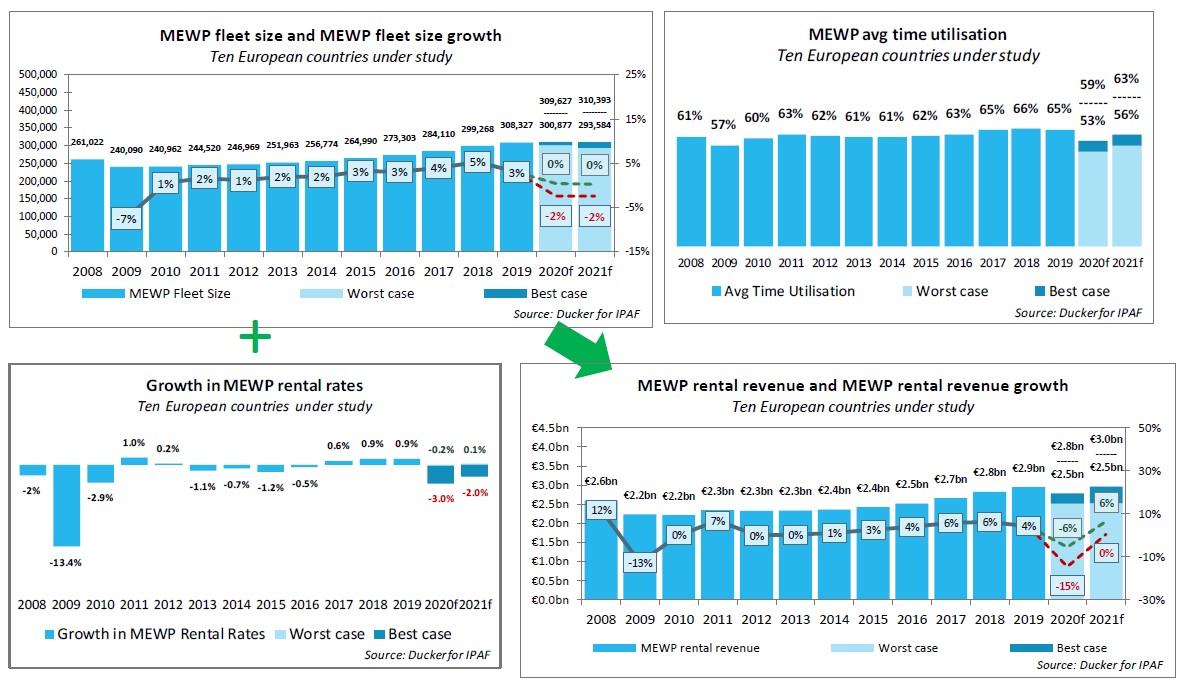

In Europe, the Dutch and German MEWP rental markets both reported strong growth right up until the beginning of the pandemic, increasing by 7% in terms of annual revenue, while France saw sustained growth over three years, to overtake the UK MEWP rental market in terms of size and revenue at the end of 2019.

Spain and Italy matched France in 2019, growing revenue by around 5%. Denmark’s total market revenue was up 3% in 2018 but the UK and Finland reported no revenue growth, well below the average for the ten countries understudy for 2019 (4%).

Spain and Italy saw continued recovery from the global financial crash in 2008-09, though the report indicates that the two markets may encounter contrasting fortunes post-pandemic. Spain’s steady recovery since 2011 looks to have stalled with the market still worth less than half (€201m) in 2019 of its total 2008 value (€429m). The gloomy outlook indicates gains could well be reversed over the next two years.

Meanwhile, the Italian market exceeded previous highs in terms of size and revenue, being valued at €290m at year-end 2019. As with Germany, Italy is predicted to recover to pre-pandemic levels of activity and revenue more quickly than Spain, owing to the versatile make-up of the fleet, dominance of relatively nimble SME rental companies, and a broadly balanced mix of construction and non-construction end-uses.

Germany and the Nordic countries negotiated the first wave of the pandemic relatively successfully and were not forecast to have been too badly hit by falls in construction output or GDP, so most are forecast to regain pre-2020 levels by the end of 2021, the effects of the ongoing second wave notwithstanding. Denmark grew strongest (3%) to year-end 2019, but had a harsher lockdown than Sweden, which is therefore predicted to have suffered slightly less in terms of falling output and revenues across 2020.

The UK MEWP rental market floundered somewhat in 2019, with uncertainty over Brexit outcomes and then a snap General Election at the end of the year fostering an air of caution and limiting bold fleet expansion or ambitious investment strategies.

In the UK, the relatively severe impact of the Covid-19 pandemic and the effects of lockdown were forecast to impact on construction pipeline, unemployment and overall GDP, which coupled with the end of the transition period for Britain’s departure from the EU on 1 January 2021 have done little to underpin confidence in a rapid recovery.

UK MEWP rental companies have shown resilience and ingenuity to maintain fleet size and rental income throughout 2019, however, for instance by offering additional services such as enhanced equipment sanitisation and decontamination to help customers keep their workers safe from the risk of spreading or contracting Covid-19.

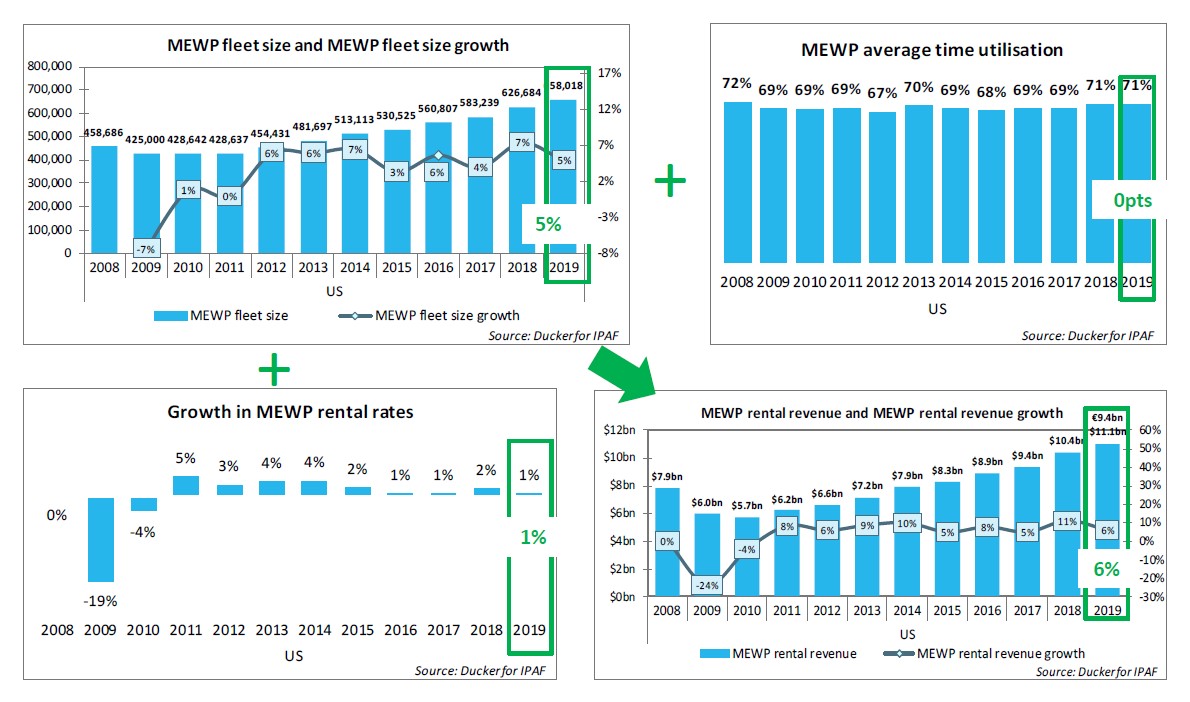

In the US, the market continues to grow and mature, boosted by strong construction output in 2019, but market evolution has been beset by a piecemeal approach to containing the pandemic in 2020, followed by uncertainty caused by national elections at the end of the year, and the fall-out thereafter. It is hoped a clearer political outlook and a renewed focus on controlling Covid-19, including the availability of an effective vaccine, can lay the groundwork for a relatively rapid bounce-back in 2021 and beyond.

As in 2019, the report also contains a special market focus on China this year and paints a picture of a MEWP rental market growing at unprecedented speed, only slightly restricted by the coronavirus pandemic, and set to keep surging in terms of fleet size and market penetration for years to come. In 2019, overall MEWP rental market value grew by 38%; while this rate of growth is unlikely to be replicated in 2020, it is still set to rise by 10% – the exact inverse of some of the worst-affected European markets.

● The 2020 IPAF Global Powered Access Rental Market reports are available to order now at www.ipaf.org/reports, with a discount available to IPAF members and a 50% price reduction on 2019 & 2018 reports. Older reports are now free to view/download. Click to view a free webinar based on key findings in the 2020 report.